See photos

See photos

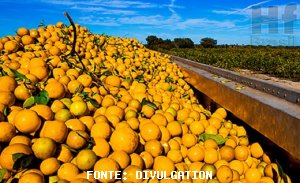

Piracicaba, 16 – Estimates indicating a significant increase in the 2017/18 orange production in the Brazilian citrus belt and contracts previously closed (from October to December 2016) by processors from São Paulo State may limit prices paid by processors for new purchases. With part of the volume already contracted and without expectations for a sharp reduction in the raw material supply, processors may have less pressure for orange supply.

The first contracts in the 2017/18 season closed in the last quarter of 2016 reached levels between 20.00 BRL and 26.00 BRL per 40.8-kilo box, harvested and at the processor – counting or not on additional participation for juice prices in the international market. Meanwhile, growers who wish to deliver their fruits in the spot market will receive much lower prices, between 16.00 BRL and 18.00 BRL per box, for both early and mid-season fruits.

Still, supply may not be too high, mainly considering the small inventories forecast for the end of the 2016/17 season. According to a report released by CitrusBR (Brazilian Association of Citrus Exporters) in December 2016, the volume stocked may total only 70 thousand tons on June 30, 2017. In this context, processors would need a large 2017/18 crop, at least to keep some volume of juice in stock.

On May 10, Fundecitrus (Citrus Defense Fund) announced that orange production in the citrus belt should total 364.47 million boxes of 40.8 kilos, a staggering 50% up compared to that harvested in 2016/17. Considering crushing nearly 300 million boxes and the average yield in the last five crops (275 boxes to produce one ton of concentrate orange juice), in June 2018, ending stocks would be limited to a little more than 200 thousand tons of juice. For these estimates, lower sales of the commodity were considered, at 950 thousand tons of Frozen Concentrated Orange Juice (FCOJ) Equivalent. Orange juice supply is still low, although higher than the volume forecast for the end of 2016/17.

IN NATURA MARKET – Weakened demand for in natura orange in SP State and the higher supply of fruits in the 2017/18 crop have reinforced the downward trend of quotes in the first fortnight of May, when pear orange prices averaged 22.98 BRL per 40.8-kilo box, 31% down compared to the average in the first fortnight of April.

Source: hfbrasil.org.br